P>So, welcome back guys. My name is Sam Lon, and yet this is another tutorial for my income tax playlist. This is yet another practical example for revision of your return, and in this case, the return will be ITR for Africa. This will be like one of my subscribers beshrew I like me a tutorial for him, and I will be trying to revise this return. So first and foremost, like, I will just go ahead and show you all the journey of firing. This is basically like what happens, I mean, any applicant while filing online returns first needs to select the return. Doesn't need, so he selects one, two, three, four, depending on what type of income he has. Here the applicant has salary as well as professional, so he has to select idea for. And then once the return has been selected, that someone has been created, it's uploaded, and that management received. I'm sorry, it's the announcement which gets generated that's idea. Roman fire needs to be signed and sent across to CPC Bango, and until the moment, I mean, this basically the XML doesn't go to the assessing officer and doesn't like it assists by this is an officer, the applicant can always go ahead and fly the revision. So that's in short what needs to be done, and now let's look at the practical way of blowing it, just minimize this. So like the applicant, because like he's running from salary as well as profession, needs to download this written idea for. So actually, I have downloaded ITR for, and I've already started I mean filling it. So inside idea for, like you all know, we have the option to customize the schedules which are applicable swing keys the applicant is not running...

Award-winning PDF software

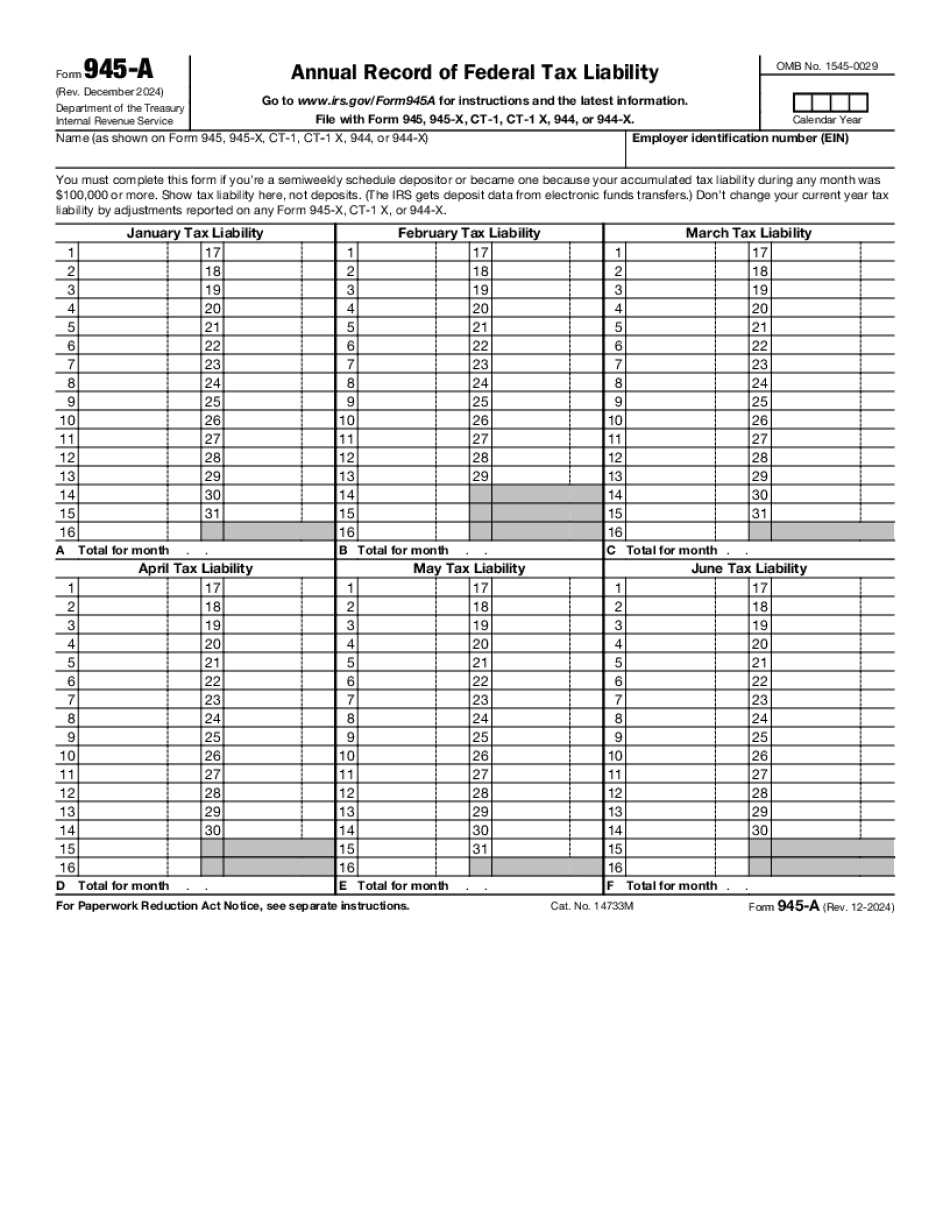

When to file 945-a Form: What You Should Know

Form 945-A (Rev. October 1997) If Form 945 is missing information on your taxes, fill out Form 945A and send it to the Social Security Administration (SSA) to have it processed. Fill out or return Form 945-A Form 945-A (Rev. October 1997) If, on Form 945 A, your tax was not paid on time, and the IRS has not paid you your tax due or has suspended this credit, call the IRS at and ask them how to file a Form 945-A (Rev. October 1997) Form 945 is available at the IRS website, at the SSA website, or download it from Form 945-A-01/01. If you use Form 945-A to report non-payments for the following tax years, make corrections on Form 945 by Dec 31, 1999, and December 31, 2000, Form 945-A — Additional Return Filed by Form 945 Form 945 is available at the IRS website, at the SSA website, or download it from Form 945-A-01/01. If you use Form 945-A to report non-payments for the following tax years, make corrections on Form 945 by Dec 31, 1999, and December 31, 2000, Form 945 is available at the IRS website, at the SSA website, or download it from Form 945-A-01/01. If you use Form 945-A to report non-payments for the following tax years, make corrections on Form 945 by Dec 31, 1999, and December 31, 2000, Filed by Form 945 If you do not have a computer, you can use the computerized form by clicking the “Forms and Publications” button on the IRS website. It will then look like this: Form 945-A — Additional Return If you do not have a computer, you can use the computerized form by clicking the “Forms and Publications” button on the IRS website. It will then look like this: Filed by Form 945 If you have a computer, you will be able to enter all the information directly on the form. Use the following steps to complete your taxes.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 945-a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 945-a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 945-a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 945-a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing When to file Form 945-a