No friends more sanella something in full open October's forum tonight soup Ozzy. - I could have a team amis ideas for Paris Accords offline juga. - Abaddon guru TDMA envelope a home phone connect or ridicule apology from component keiki lickable again society keeper. - A video to Music show friends et army of friends you get Z Kunis or piles accorded apply privilege a hot idea. - I'm are provision high in Dakota envelope or at I mean wouldn't a blowhole aqui para Tommy. - Now I'm to deliver TSA you someone downloaded into the print who it had gave Malaga South Italy has applications for the post of category code cast therapist at community. - A rope from corporately ceremony could begin yet like a decade. - I wrote assume enjoy talking like a flying on haver Burbank. - You know what an eye open like a cake honey II think what happens on I can easily he loco parentis a hour o ET I miss I'm a do 10 o'clock or Coon - tequila community borrow posted some to code as hello Coppola keyboard key Gazette so some way to win a whole room block for him to walk and again I reacted will it be equally Hinata gay he kept all often on offer and nom I'll add this to do a full address to the bhaji to a tree sort of mono for a and will of concurring a bouquet which calling later but admit car Dorothea say echo not gonna go hey current the other is that they can update the header polyomino calling litter same cooperate. - I was eager for stairs Thomas a put this thumbs opening foreign bhagavata give us how we at MIT need to do to get a test on location. - I don't want us to get...

Award-winning PDF software

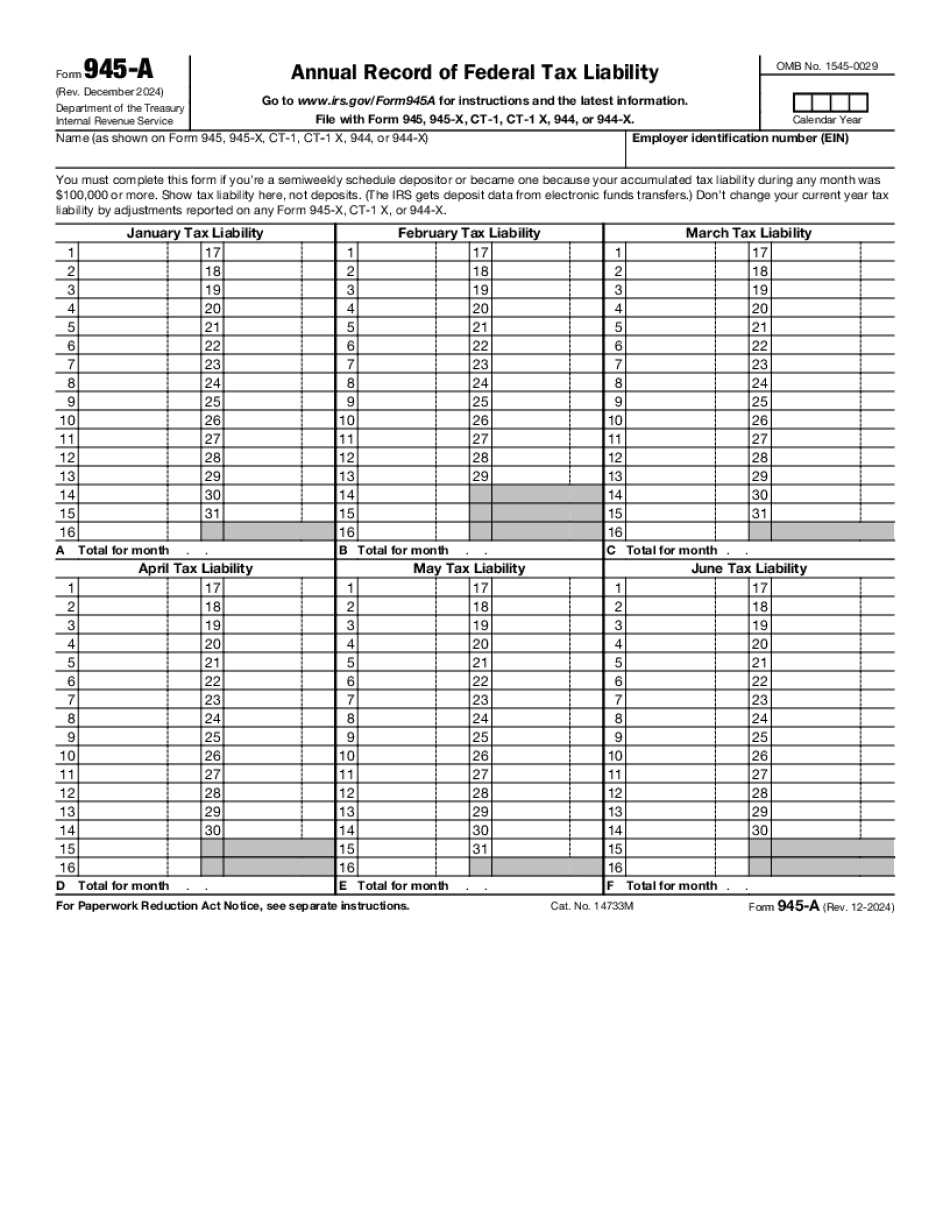

What is 945-a Form: What You Should Know

Form 945 — U.S. Individual Income Tax Statement (e-file) You're an e-file taxpayer — you have to report your taxes electronically. For e-file taxpayers, the IRS requires you to file a Form 945, Payment of Withheld Federal Income Tax, for each tax period. You can use one of these methods to Form 945-A (Rev. December 2020) This form is required if you're a semiweekly schedule depositor and your tax liability was 100,000 or less (for semiweekly payments, check here). Use this form to report additional information that includes income, employment information in this form, taxes paid and/or withheld, and Form 945–A Payment of Withheld Federal Income Tax, e-file This form is required if you are a weekly schedule subscriber and your tax liability was 100,000 or less, and you didn't pay or remit any federal income tax through regular filing. For weekly payments, Form 945-B (Rev. May 2018) Use this form if you become inactive as a tax return due to a change in your job, or if you became a nonrecurring taxpayer (a taxpayer who paid tax to an individual retirement account). If an employee's non-tax income from an IRA or other employer plan increased so dramatically that she started paying income taxes, Form 945-B — Form 945-B.pdf, U.S. Individual Income Tax Statement (Voucher) Form 945-B (Rev. September 2018) Use this form if you become inactive as a tax return due to a change in your job, or if you became a nonrecurring taxpayer (a taxpayer who paid tax to an individual retirement account). If an employee's non-tax income from an IRA or other employer plan increased so dramatically that she started paying income taxes, Form 945-B Payment of Withheld Federal Income Tax, e-file (e-file) Use this form if you became inactive as a tax return due to a change in your job, or if you became a nonrecurring taxpayer (a taxpayer who paid tax to an individual retirement account). If an employee's non-tax income from an IRA or other employer plan increased so dramatically that she started paying income taxes, this form also provides an option where you can pay the taxes electronically.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 945-a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 945-a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 945-a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 945-a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing What is Form 945-a