Introduced in the Sun for SER 945 heavy-duty retail scanning cash register, the 945 is the top machine in the 900 series. It has a raised keyboard with 56 PLU buttons which can be pre-programmed with the description and price, or left open to allow manual input. If you order the register on our Platinum service, we will program each of these PLU buttons and include a key cap, so the product description is shown on the button, screen, and receipt. The 945 has a PLU memory of 10,000 lines. You can sell PLUs by pressing one of the 56 PLU buttons, using the PLU number key, or using it with a barcode scanner. On our Platinum service, we will pre-configure all of this, so all you need to do is add your own barcode products. The 945 is a twin roll cash register. On the left-hand side, there is a receipt printer, where the header can be customized with your shop name, number, and other company information. Each line of the sale is detailed on the receipt. On the right-hand side, there is a journal roll which acts as an auditor, recording every transaction. The 945, like all the Sam 4s cash registers, is SD card compatible. Reports can be backed up to the SD card, including programming information. This is useful if you have a lot of PLUs on your scanning file. Now let's take a closer look at the key lock. Like all these sample registers, there is a regimen for processing transactions. There is an X button for manager mode, a Z position for reporting, where you can produce an end-of-day sales report and a PLU report. There are also function keys for amending product prices. The 945 has a clock number button for logging in...

Award-winning PDF software

945 2025 Form: What You Should Know

Form 1120–2, Annual Form, Self-Employment Income Learn how to fill out Form 1120–2, Annual Form, Self-Employment Income. This form was developed during tax preparation for a self-employed person or employee. It is designed to simplify the reporting of your self-employment income and can also help you file Form 940 to have your self-employment tax withheld at no tax. IRS Form 940–EZ. IRS.gov, “What's New” section 2018 Income Tax Changes and 2025 Tax Changes 2018 Information For 2025 Taxpayers Learn what the IRS has done so far for 2025 tax returns filing. Learn why we are increasing your standard deduction. Learn that 2025 tax returns cannot be processed any earlier than the filing due date on November 15 for the following taxpayers: Individual taxpayers who must file a U.S. Individual Income Tax Return due April 17, 2025 (January 1, 2019) and filed the 2025 tax return or a federal return. Individual taxpayers who must file a U.S. Individual Income Tax Return due April 17, 2025 (January 1, 2019) and filed the 2025 tax return or a federal return. U.S. taxpayers who need additional information, including those taxpayers who are filing Form 1040NR, Form 1040NR-EZ, Form 1040NR-SP, or Form 1040NR-SS Individual taxpayers who do not have enough information for their 2025 tax return (due January 31, 2018). U.S. taxpayers and their respective taxpayers. See the IRS Publication 6155, U.S. Individual Income Taxes for more details on these and other changes and changes for all taxpayers over the age of 55: Annual tax rates on income, deductions, exemptions and credits for 2025 tax returns. Learn more about changes for Tax Day 2025 and 2025 tax deadlines. Change To The Self-Employment Tax Payment Process The IRS has announced changes to the process for processing self-employment tax returns due for payment on April 17, 2018. These changes will allow the payments to be processed more efficiently by the payment processor. The changes apply to U.S. taxpayers and their taxpayers in other countries. Click here to find out more about the changes. Tax Filers May Receive Changes to Self-Employment Tax Payment Due Dates In 2018, a payment deadline change means taxpayers can expect to receive notifications when their tax return must be submitted by April 15.

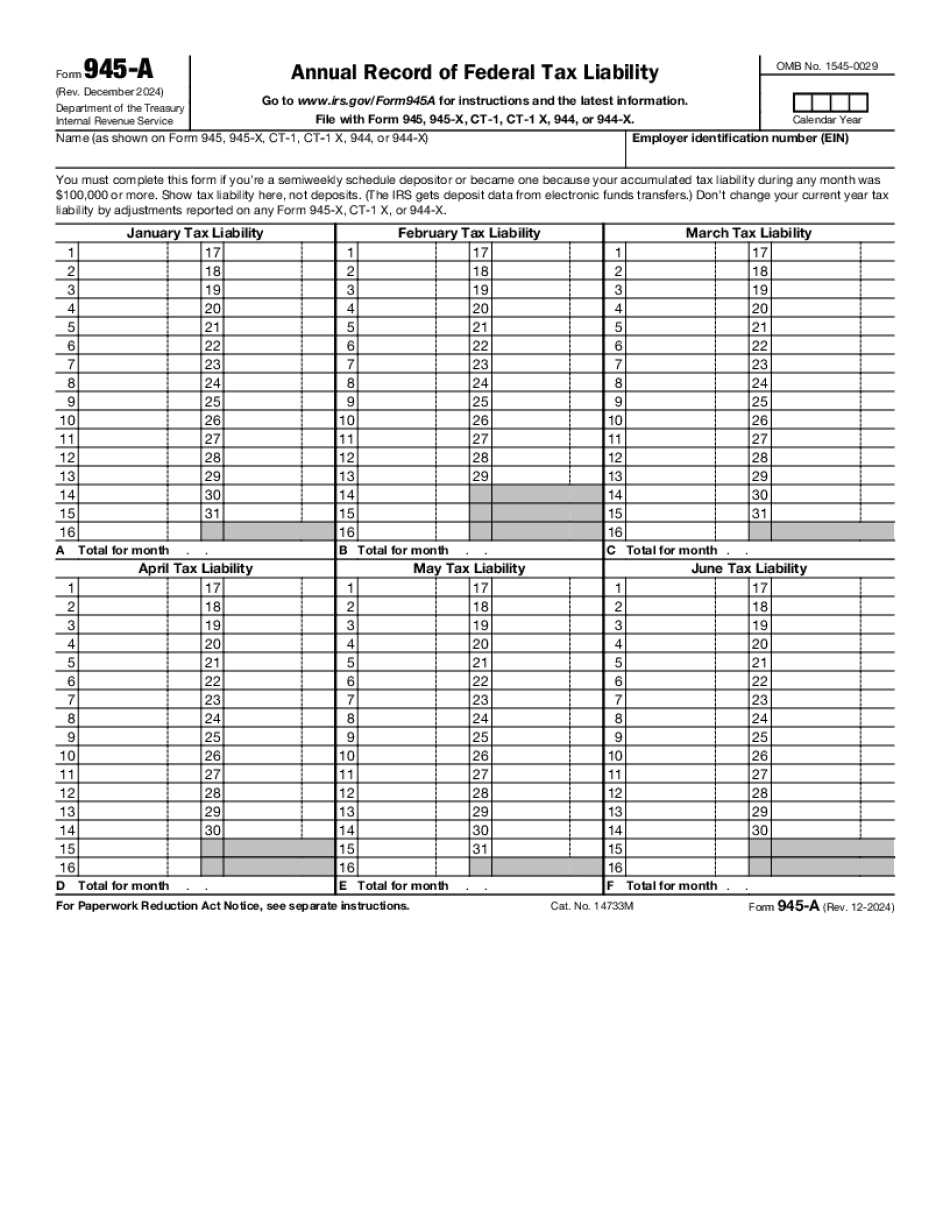

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 945-a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 945-a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 945-a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 945-a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 945 2025