Here is the corrected and divided version of the text into sentences: How to cash a check in our digital world of direct deposits and money transfers via smartphone apps? Old-fashioned paper checks or cheques are still issued for a variety of reasons. Whether it's a birthday cheque from your grandma or a business or government issue cheque, even the most tech-savvy individuals need to cash checks sometimes. Knowing how to make sure a check is valid and how to cash it safely and inexpensively will help you get your money as quickly as possible. Cashing a check at your bank is one option. Bring a valid photo ID to any branch of your bank. If you hold an open account of any type with a bank, they will cash a valid check for you. However, when you cash a cheque in person, you may be required to show a valid photo ID. Driver's licenses and passports are usually the best choices. In some cases, military or school IDs may be accepted. Many banks prefer that you have your bank debit card with you as well. If you do not have your debit card, you may be required to fill in additional forms to cash your check. Contact the bank branch with any questions about their ID requirements. You won't be required to show a photo ID if you cash the check at an ATM or via your smartphone. Cash your check with your bank teller. This is the easiest method for getting the money you have earned quickly and safely. Show the teller your ID or hand them your debit card if requested. Never sign the back of the check before you arrive at the bank. Instead, do it in front of the teller as you cash it for ultimate security. Deposit...

Award-winning PDF software

945 deposit due dates Form: What You Should Know

Backup Withholding Forms Filing Deadlines | NTP Q: What is IRS Form 945? — Gusto For 2018, Form 945 will be due on February 28, 2019. The information returns listed below are used to report backup withholding for tax year 2018. They're generally due to the IRS on Friday, February 26, 2019, for Q: What is IRS Form 945? — Gusto The information returns listed below are used to report backup withholding for tax year 2017. They're generally due to the IRS on Friday, February 25, 2019, for Q: What is IRS Form 945? — Gusto For 2018, Form 945 will be due on February 28, 2019. Backup Withholding Forms Filing Deadlines | NTP For 2017, Form 945 will be due on February 1st unless that day falls on a federal holiday or weekend, in which case it will be due on the following normal When is the IRS Form 945 Due? Who Uses Form 945? Backup Withholding Forms Filing Deadlines | NTP What To Do If The Due Date Is On A Weekend/Holiday? The IRS can extend deadlines once a year for the filing of information return due to tax year 2018. For example, the due date for 2025 is May 22, 2018, at 11:59 p.m. EDT May 23, 2018, at 12:01 a.m. EDT May 24, 2018, at 9:00 a.m. EDT (or on Tuesday, May 24, 2025 any day) You can extend the due date for the filing of any year tax information return by submitting Form 4868, Extension, to the IRS. The extension will become effective on January 31 of the following tax year. The IRS will consider a request for extension to a future tax year. However, the IRS will only consider a request for an extension of one year in advance. After the extension is issued, the form is considered filed to the tax year the extension relates to. For more information about extensions, read Using Extension Request Form 4868. Backup Withholding Forms Filing Deadlines | NTP What Can I Do If I Can't File A Tax Return Because of a Tax Payment Error? For the 2025 return, there's a special time to file an amended return if you need more time to make your payment.

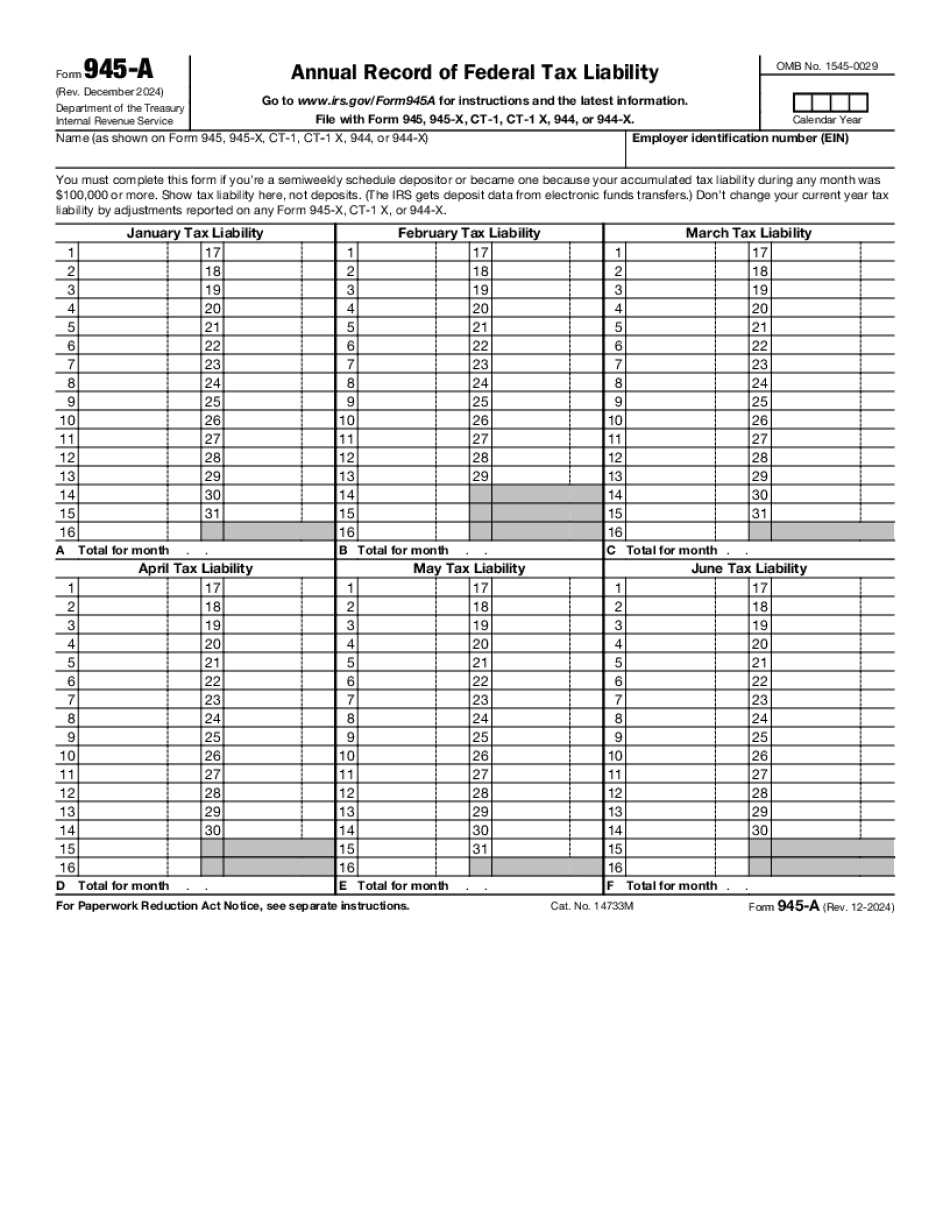

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 945-a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 945-a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 945-a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 945-a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 945 deposit due dates