Award-winning PDF software

About form 945-a, annual record of federal tax liability - internal

Other resources IRS Tax Topics, including topics on filing taxes yourself, tax preparation guides, and tax credits.

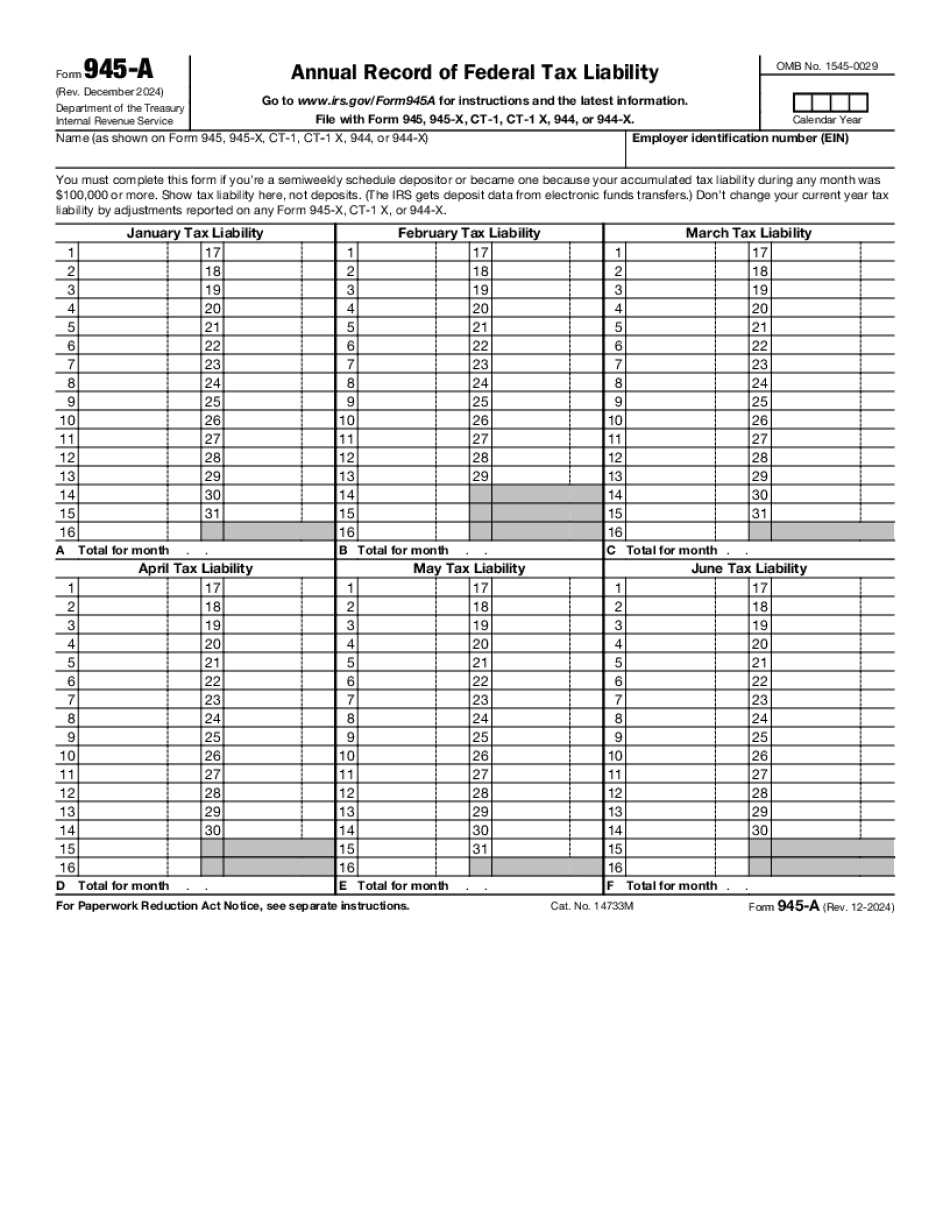

form 945-a (rev. december ) - internal revenue service

For example: If your bank started accepting semiweekly plans on October 1, 2017, and you were required to submit a semiweekly deposit form for the first time on January 1, 2018, submit this form by February 1, 2018. If your bank started accepting semiweekly plans on October 1, 2016, and you were required to submit a semiweekly deposit form for the first time on December 1, 2016, submit this form by May 1, 2016.

form 945-a "annual record of federal tax liability"

PDF .

Form 945-a - annual record of federal tax liability - omb 1545-1430

The IC contains information about all federal tax liens filed over the past five years. The tax liability is listed in the form.

Form 945-a annual record of federal tax liability - omb 1545-1430

For instructions on completing or using a Form 945-A, refer to the instructions for the most recent version of Forms 1040 and 1041. Your income tax return is part of that reporting. Use Form 945-A to prepare your return. Do not file Form 945-A if you: did not receive wages or payments for the period covered by the return. Did not receive amounts for which a withholding agent claimed to have paid. If you are not eligible to use Form 945-A, you will file a paper return. If the returns are filed with Form 940-ES or Form 1040-ES, you will receive Form 2350, Information Statement on Federal Tax with respect to Certain Individuals Not Eligible to Use Form 945 or Form 941, or you can submit Form 2350-A, Income Tax Return for Individuals Not Eligible to Use Form 945 or Form 941, Request for Proof of Eligibility. If both income.