Award-winning PDF software

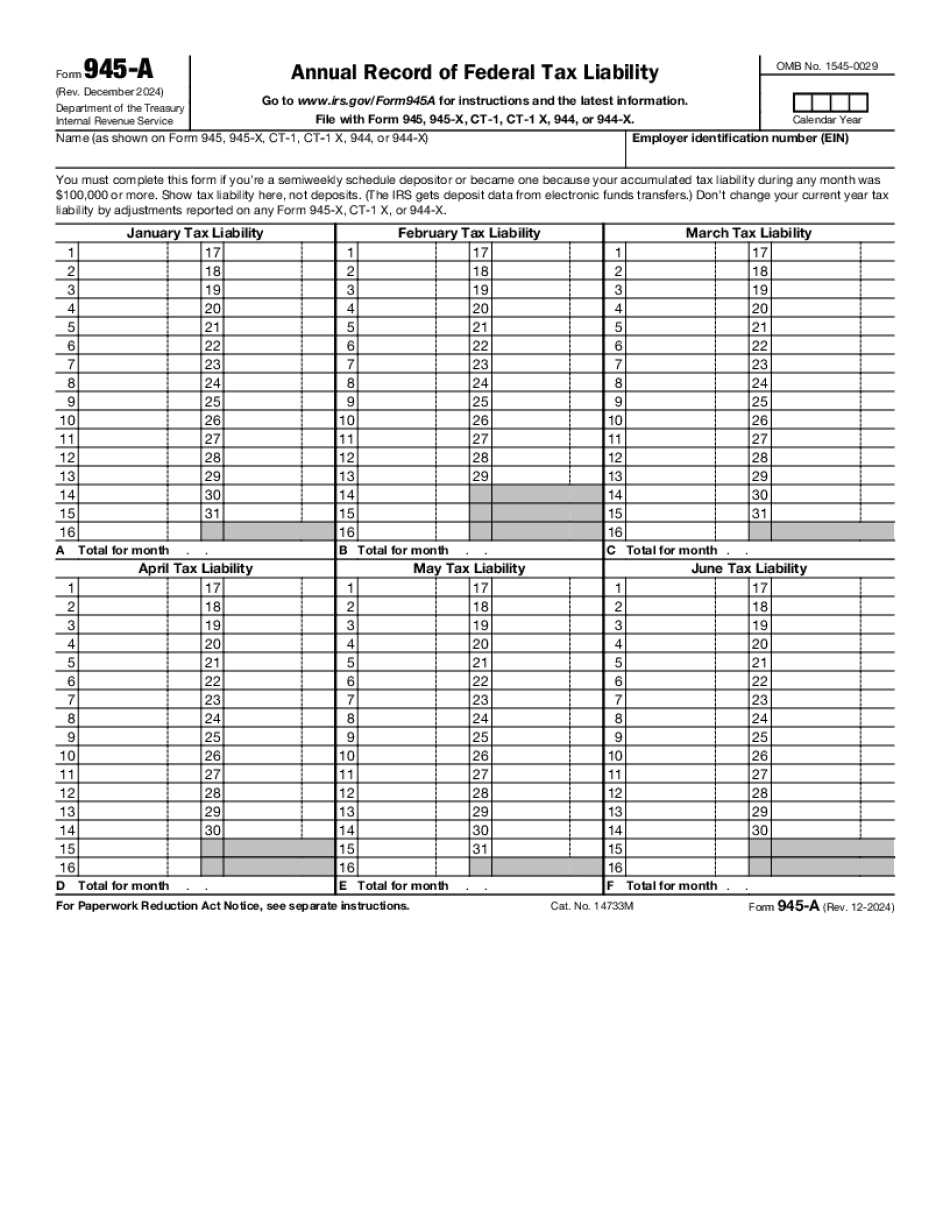

Ann Arbor Michigan Form 945-A: What You Should Know

Ann Arbor, MI Accounting Firm Or Informational letter August 27, 2009, Employers and taxpayers can check for errors in their current payroll tax withholding using these forms and guidelines. U.S. Department of the Treasury Form 945, Annual Return of Withheld Federal Income Tax — Employers use this form to report withholding taxes withheld from nonpayroll payments. This form is available on the Treasury's Website. The Treasury's Form 945 is available in this PDF file. September 8, 2009, Form 945 may be used to report withholding taxes on wages deposited into an account for an employee. Ann Arbor, MI Accounting Firm | Newsletters Page May 6, 2006, Form 945 provides information for the purpose of correcting payments, deductions and credits related to employees' earnings. Ann Arbor, MI Accounting Firm | Newsletter Page September 29, 2005, Form 945 provides information for the purpose of correcting payments, deductions and credits related to employees' earnings. April 10, 2011, Form 945 provides information for the purpose of making payments or deductions of all income of self-employed individuals. (Employees are included in determining whether you may use this form). April 10, 2011, Form 945 provides information for the purpose of making payments or deductions of all income of self-employed individuals. November 1, 2001, This form can be used by the Federal Tax Administration to notify individuals of their rights or requirements to make annual returns. July 13, 2001, Form 945-T (Treatment of Certain Payments by Businesses and Organizations) may be used by a business to file a tax return or to withhold tax from payroll benefits if it is reasonable to believe: -The employee will withhold tax from any such payments -The total withholding for the year does not exceed the normal tax withholding liability and -The employee pays more than one person who makes payments to him or her. August 3, 2007, The purpose of the Form 945-T is to assist the taxpayer when he or she is delinquent on his or her employer's tax or tax-filing obligations. Federal Information Agency. Frequently Asked Questions page The Treasury makes every effort to keep the forms and forms information current. In general, this list will be updated, but is not guaranteed to be complete or up-to-date.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Ann Arbor Michigan Form 945-A, keep away from glitches and furnish it inside a timely method:

How to complete a Ann Arbor Michigan Form 945-A?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Ann Arbor Michigan Form 945-A aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Ann Arbor Michigan Form 945-A from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.