Award-winning PDF software

Form 945-A Carmel Indiana: What You Should Know

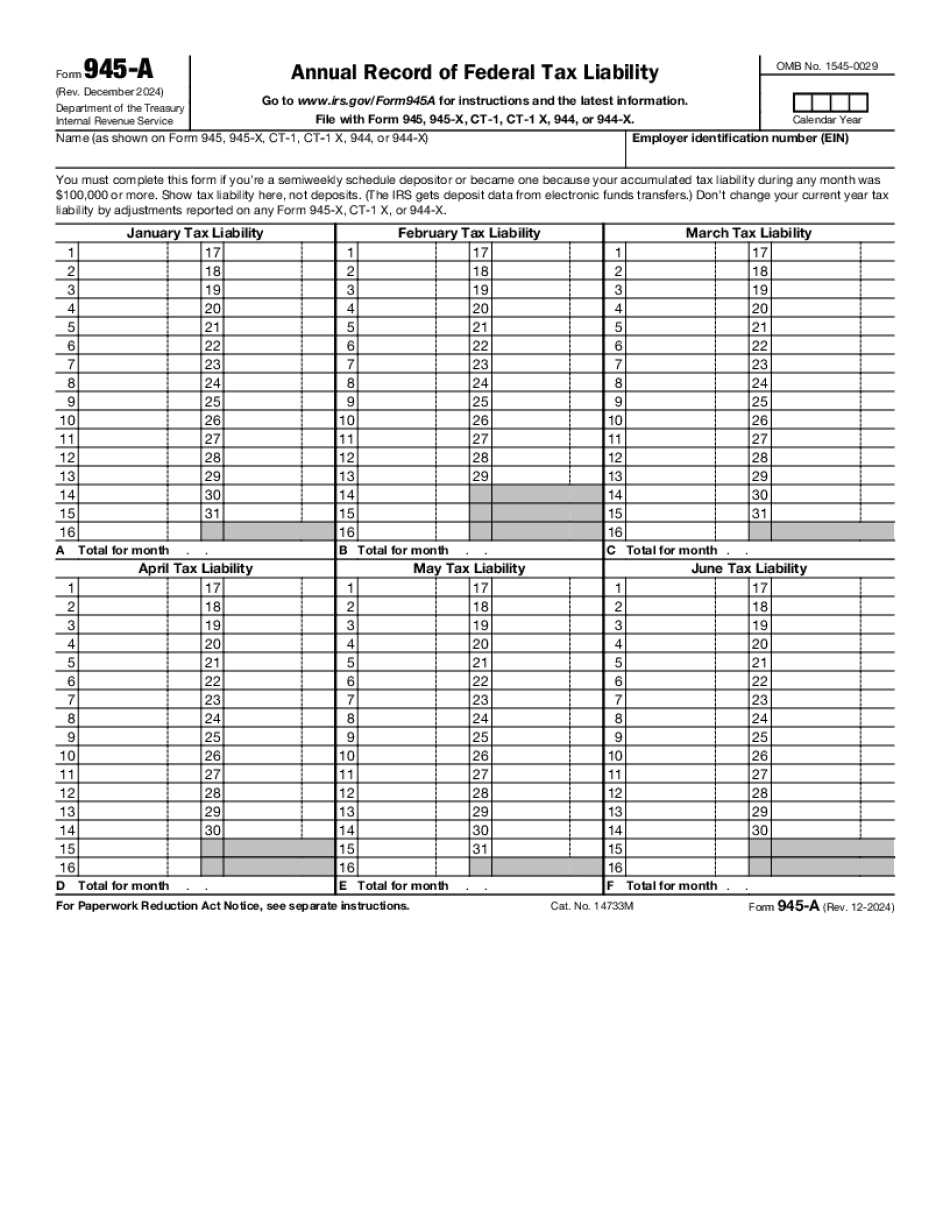

Form 945-A — Use this form as proof of your nonpayroll income tax withholding, or as a starting point to develop a nonpayroll withholding schedule based on the types of wages and payments paid. Form 945-A (Rev. December 2020) Purpose of form. Use this form if you are a semiweekly schedule depositor. You should use this form to report nonpayroll income tax withholding based on the dates you made payroll deposits. Form 945-A (Rev. October 1997) Purpose of form. Use this form if your nonpayroll income tax withholding includes taxes due for the 2025 tax year. Form 945-A (Rev. September 1998) Purpose of form. Use this form if a new payroll deposit, paid by check, will be due by April 15, 2018. The deposit must be included in the tax liability amounts on this form. If there are two or more withholding for the same year on this form, enter the lower total on the form to determine whether the deposits are equal. Form 946 (Form 946) Newly Renovated Apartments for All the Families! Grammy is located in the heart of Carmel and boasts the largest apartments in town. The newly renovated apartments are now yours for the taking! Newly Renovated Spacious Apartment! Grammy is located in the heart of Carmel and boasts the largest apartments in town. Make Grammy your new home. This form must be completed by the filer to determine whether the tax liability is zero tax liability. Form 946-A (Form 946-A) Purpose of form. Form 946-A is used to report nonpayroll income on the date deposits were made. Form 946-A will only be valid for one year. Form 947 (Form 947) and Form 947-EZ (Form 965) Form 947 (Form 947), also known as IRS Form 947 for individuals and Form 947-EZ for trusts, is the form filed with the Internal Revenue Service by non-institutional creditors who are paying a tax liability based on the date deposits were made, not the amount deposited. This form must be completed by the filer to determine whether deposits are equal. Form 8993 (Form 3520) An annual form showing interest, penalty interest and all expenses incurred in collecting a tax return.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 945-A Carmel Indiana, keep away from glitches and furnish it inside a timely method:

How to complete a Form 945-A Carmel Indiana?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 945-A Carmel Indiana aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 945-A Carmel Indiana from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.