Award-winning PDF software

Form 945-A for Portland Oregon: What You Should Know

And your account information and personal information is kept absolutely safe. Oregon state tax forms are available online for free Use Tax Finder to see how your state taxes you and find free resources that help you figure out your tax bracket, tax rate, and more. It's a great way to stay ahead of your tax obligations. State tax records available for purchase at the Oregon Department of Revenue The Oregon Department of Revenue provides free state tax records, records search services, free publications, and other services for individuals and businesses to help you understand and manage their state income tax liability. Search for tax records: Oregon Department of Revenue Taxpayer Assistance The Oregon Department of Revenue offers free tax services for taxpayers throughout Oregon (for the Oregon Permanent Fund Dividend). For more information, download this brochure. Oregon Department of Revenue What is the Personal Property Tax? The Oregon Property Tax (aka Personal Property Tax) is a tax that applies to the value of property sold in Oregon. It is imposed on the payment of property taxes, and does not apply the property to taxable income. For more information, see How a sale of personal property affects the seller and how the Oregon Personal Property Tax works. Personal Property Tax Rate — Property Tax Calculator Oregon Sales Tax The Oregon state sales tax (6% of sales price) is based on Oregon's Local and County Sales Tax Exemption Rate. The exemption may be different for each county. Taxable rates for goods in Oregon: (8.75%), (9%), (10%), (12.5%), (13.75%), and (30%). Taxable rates for services in Oregon: (8%). Oregon Business Tax Rates Businesses may have their Oregon sales tax charged on total gross sale price, or the total amount of gross sales from a single transaction. The Business and Occupation Tax (BOOT) is on business and sales of goods and taxable services that are worth more than 250, except for services valued at less than 250. FEDERAL Taxes FICA, FTA, and ETC Taxes: The Federal income tax returns may be filed electronically using Electronic Federal Tax Payment System. The Federal Insurance Contributions Act (“FICA”): Includes self-employment tax, social security taxes, and Medicare taxes deducted from paycheck or wages. FICA payroll taxes are paid every two months. Income from interest, dividends, and capital gains are generally exempt from tax.

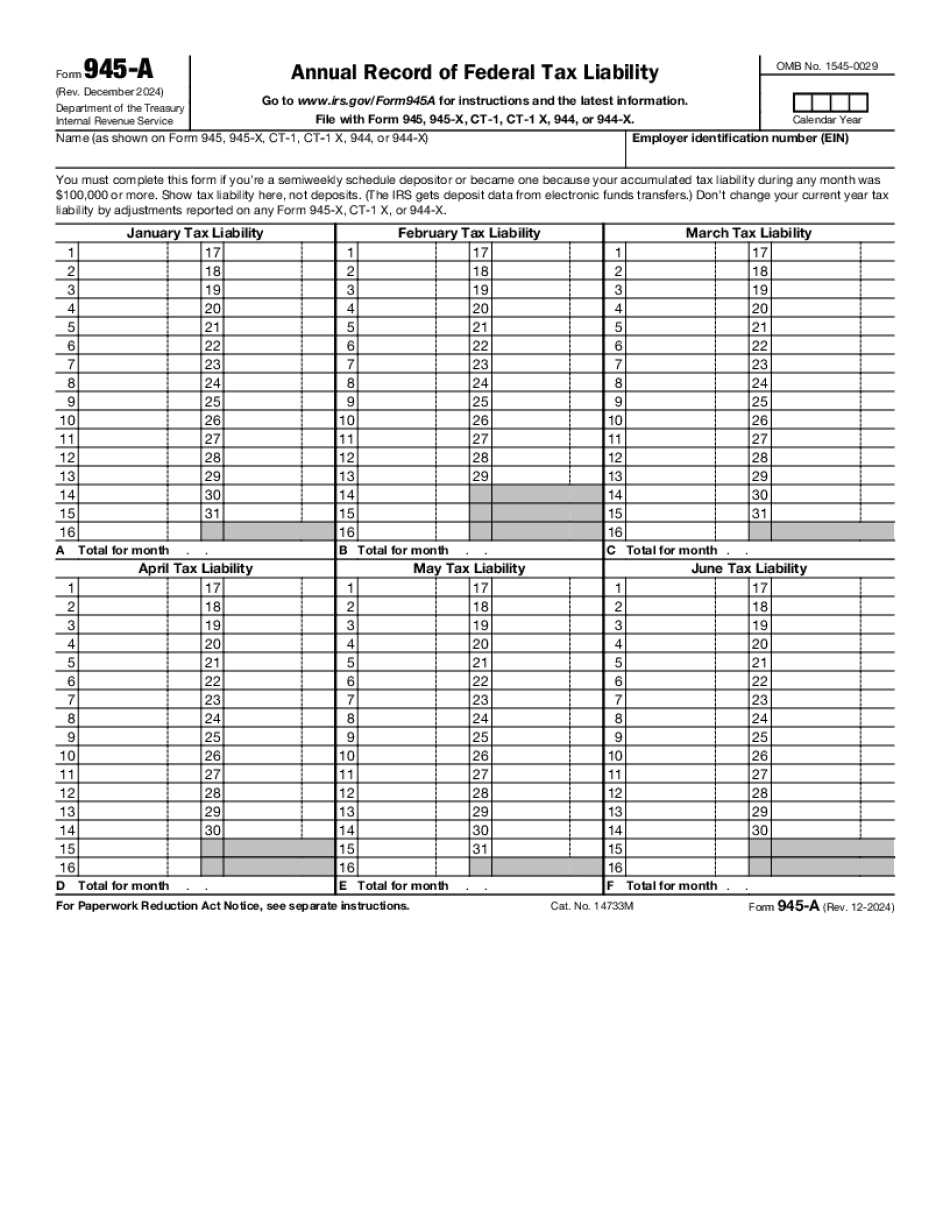

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 945-A for Portland Oregon, keep away from glitches and furnish it inside a timely method:

How to complete a Form 945-A for Portland Oregon?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 945-A for Portland Oregon aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 945-A for Portland Oregon from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.