Award-winning PDF software

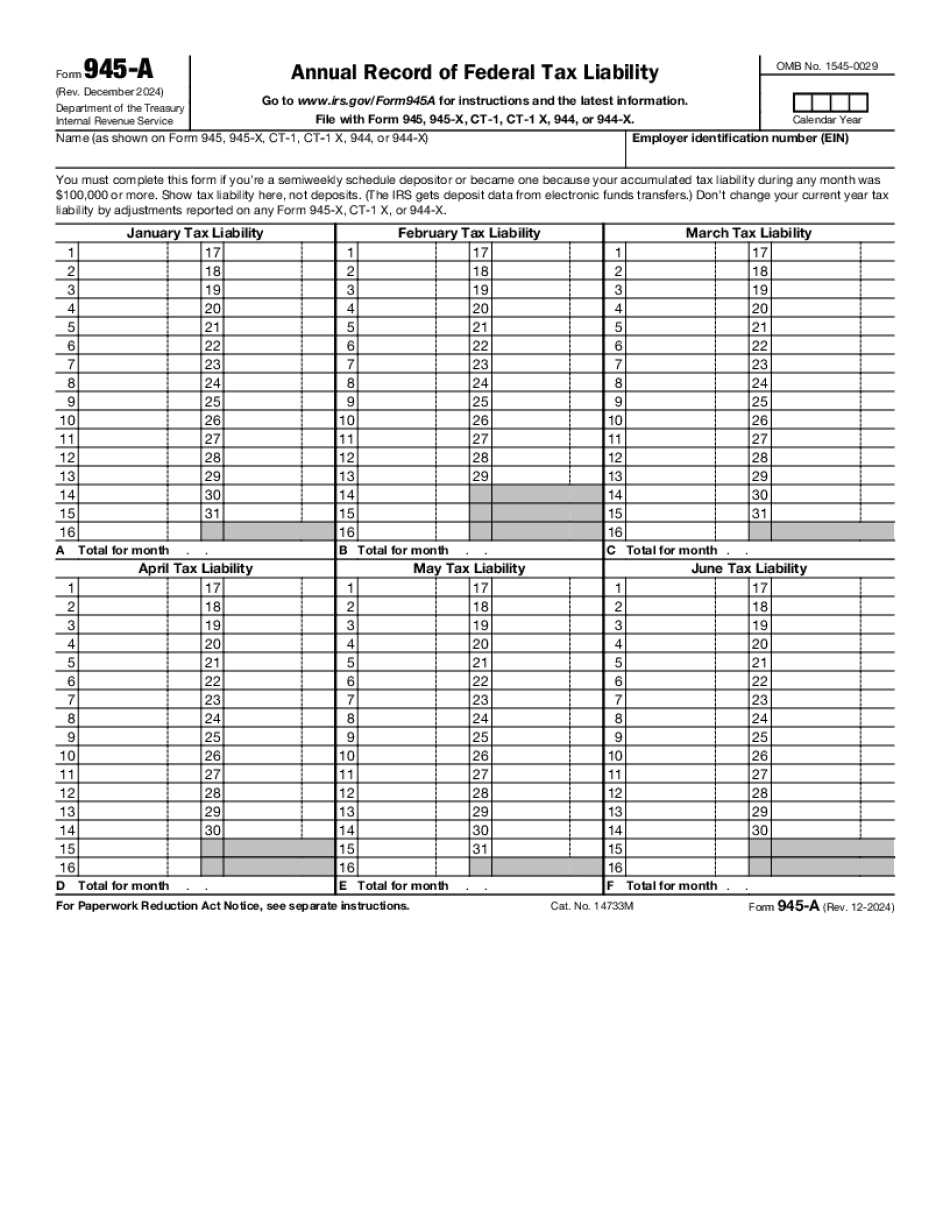

Form 945-A Huntington Beach California: What You Should Know

If your quarterly schedule deposit was not fully paid by the first day of the quarter, you must file Form 945-A. For more information, call us at or email us. Top 500 Sales & Use Tax Delinquencies in California — CDTF Name1st Lien DateBalanceNBA AUTOMOTIVE, INC. DBA HOLMAN CHEVY01/15/2020 5,400,000.00ABOLGHASSEM (ABE) ELIZABETH “(11/04)500,000.00 Cal trans Customer Account Recovery and Customer Services If you made an erroneous payment on a vehicle, you may be able to recover a portion of the payment with our help. If you are a customer in CA and a Cal trans employee, you may be eligible to apply for this service to help correct a tax lien owed to the California Department of Motor Vehicles, such as the following. You will be contacted by a Customer Care Representative to schedule an appointment. You will receive a letter shortly after your scheduled appointment giving you a payment amount based on your payment history with the Cal trans Customer Relations Center. The payment amount will be given to the customer and recorded in this case. Note that while this service is offered, in some cases we simply won't receive your payment. This would happen if it is less than 500, and it does not meet the above criteria. We will advise you of your options. Please note: This service is provided free of charge by Cal trans. For more information, call Cal trans Customer Care at least 6 business days before your scheduled appointment. Top 500 Sales & Use Tax Delinquencies in California — CDTF Company Tax Exempt If you had any nonbusiness income that you had not included in calculating your gross state income tax. You can claim this exemption under Section 162(m) of the Internal Revenue Code. To qualify for this exemption, you must be incorporated and your exempt annual income for the previous two years must exceed 20 million for the California tax year. If you are not an incorporated entity, or you do not meet the above criteria, you can still claim this exemption by filing Form 1116. If your federal tax return has information pertaining to this exemption on line 16, you can file Form 1116.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 945-A Huntington Beach California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 945-A Huntington Beach California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 945-A Huntington Beach California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 945-A Huntington Beach California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.