Award-winning PDF software

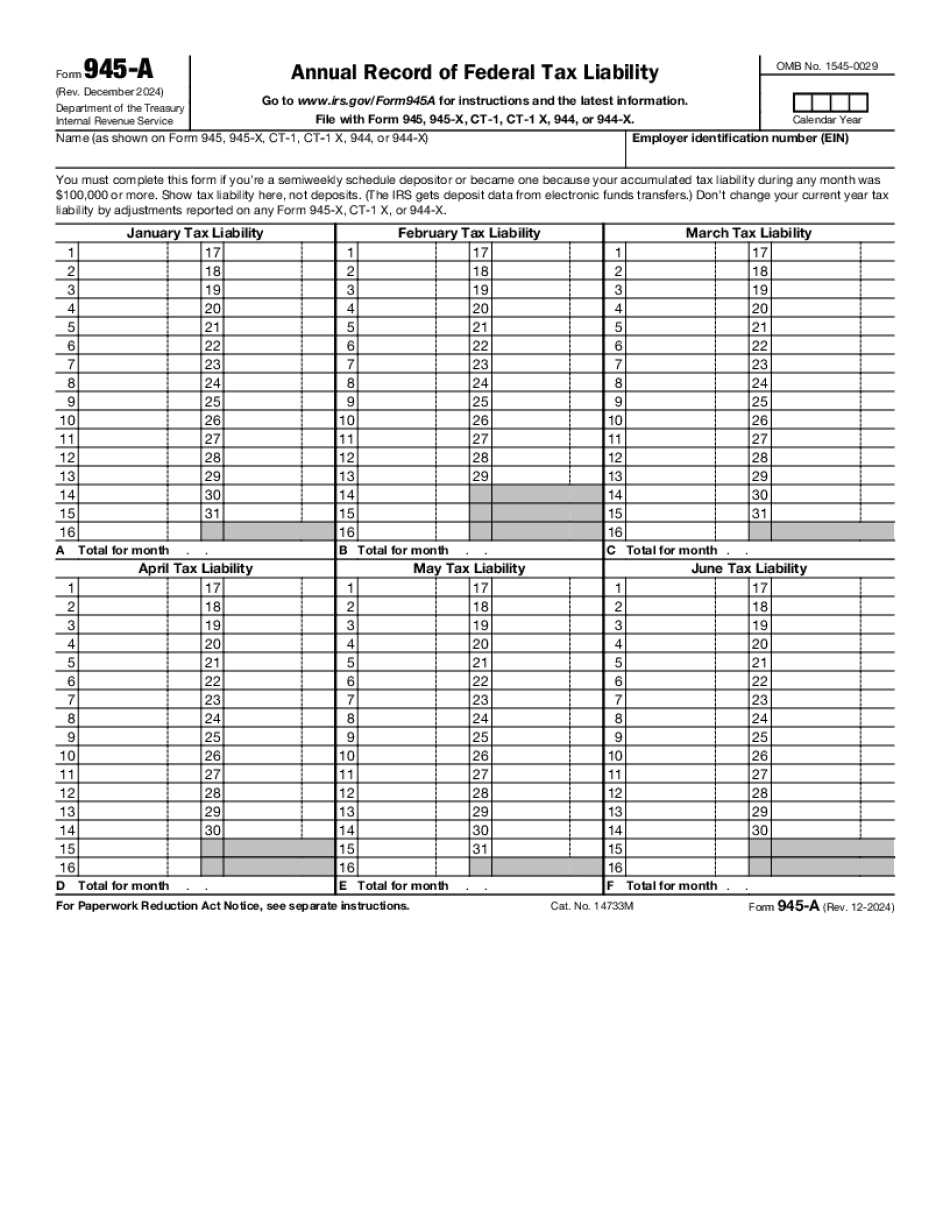

Form 945-A online Gresham Oregon: What You Should Know

This form may also help you to resolve tax issues as you continue with the tax season. Citizens' group to help employees understand and resolve federal tax withholding Oregon Wage Theft Coalition — These non-profits is a non-profit corporation for those residents of U.S. states that have chosen to adopt the federal Fair, Reasonable and Transparent Collection of Fines Act (FIRST) to collect unpaid federal income taxes, which provides remedies for those who are unable to pay such taxes themselves for various reasons. Form 4976—Tax Return Preparation and Reporting: Oregon Department of Revenue The “Oregon W-4” (Oregon resident's 4-digit paycheck) form is filed by employees. These forms are the primary means of reporting, paying and collecting wage garnishment, debt collection, child support and tax refunds. Form W-10—Payable to Oregon--Form W-10 is the means by which payroll taxes are filed. Filed in the payee's name, this form helps employees verify their current income tax filing requirements and verify their payments. There are currently 19 versions available. Form W-2—Employee Wage and Tax Statement--The Form W-2 is a return of income (pay check) that reflects a taxpayer's wages paid to the United States by the payee or former payee. The return provides information on wages and the amount of all income tax withheld for tax purposes. The form also provides a record of the payee's income tax exemptions. This form is not completed by a taxpayer unless they are receiving a federal tax refund under the Internal Revenue Code. Form W-3—Payable to state—The Form W-3 is a return of income (pay check) that reflects a taxpayer's wages paid to another state by the payee or former payee. The form provides information on wages paid, including the amount withheld for state taxes, and the amounts withheld for self-employment taxes, social security and Medicare taxes and other federal taxes. Employer Responsibility to Report California Payroll Income California has a law that requires employers to report wages earned by California employees.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 945-A online Gresham Oregon, keep away from glitches and furnish it inside a timely method:

How to complete a Form 945-A online Gresham Oregon?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 945-A online Gresham Oregon aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 945-A online Gresham Oregon from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.