Award-winning PDF software

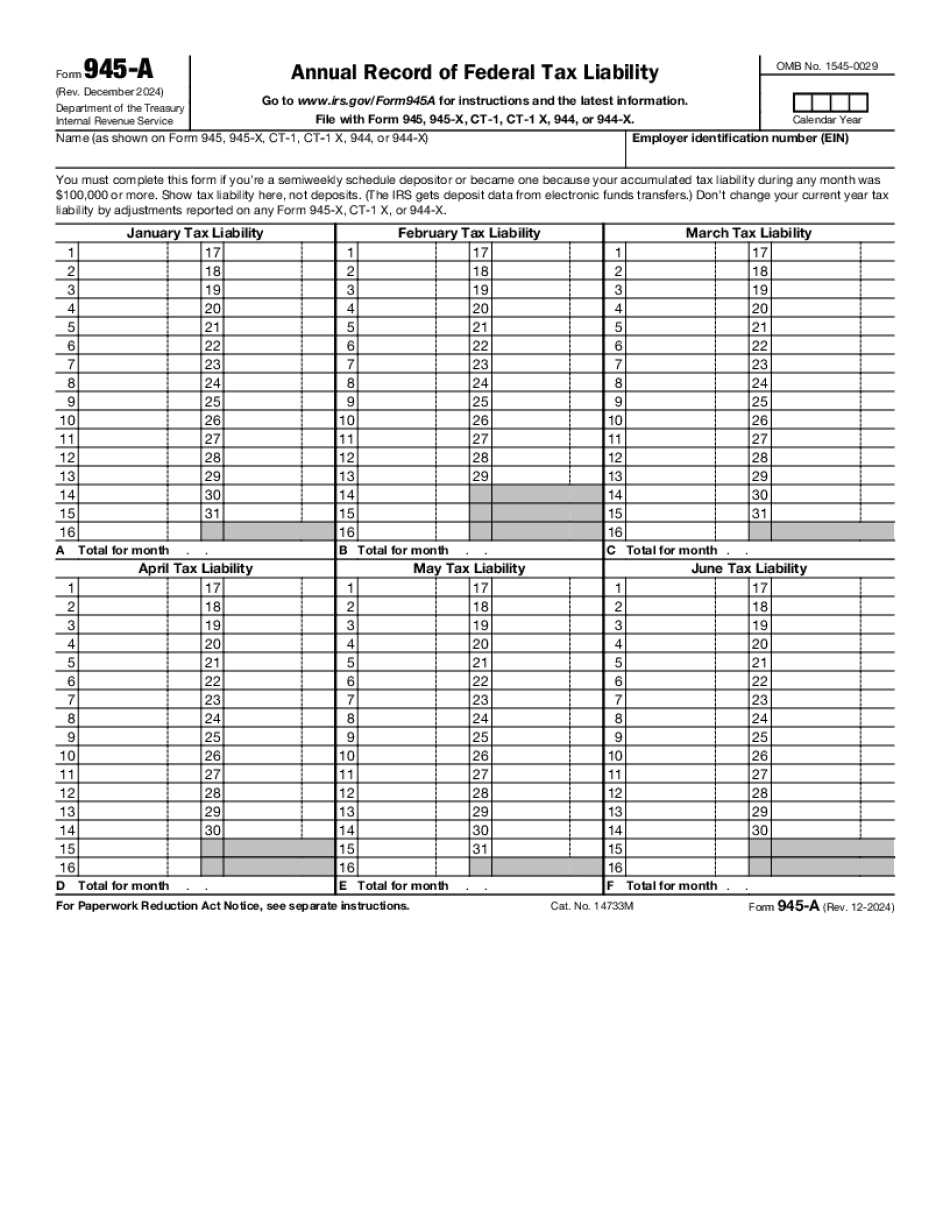

Murfreesboro Tennessee Form 945-A: What You Should Know

DMV box office. Tax Forms, Statements, and Instructions — TN.gov Tax forms, Statements, and Instructions for State and Local Governments are available for free on this site. For information on other state agencies, please go to Tennessee Department of Safety Department of Public Safety DNR — TN.gov Use this site to locate regulations and other state documents related to DNR. TN State Foresters — TN.gov The TFA will send you more information about your TFA when you request your State Forester's License for the next year. Tennessee Fish and Wildlife Commission — TN.gov The DNR will send you more information about your DNR license and DNR license renewal when you request your Fish and Wildlife license for the next year. State of TN — TN.gov Use this site to locate a map and contact information for Tennesseans for hunting, fishing, and environmental issues. TIP When making a tax return online, you must enter your date of birth or Social Security number to avoid having your tax refund automatically credited the date of your birth. The online tax return system asks for date of birth or Social Security Number for tax return filing. TIP To file your tax return by mail, you must enter your Social Security number and the four digits from the last 4 digits of your Social Security check to avoid having your tax claim automatically crediting the date of your check. Tennessee has its own online state income tax service, or “I.R.S.” For information on tax rates, filing status, mailing addresses, and contact methods, please visit the website. If you have any questions, please call 1–866-662–4289. For more information about how to file your tax return electronically, visit Tax-exempt.net. For questions about using a computer-aided filing system for Tennessee tax return preparation, see How to file your return electronically with Computers and Other Information Systems. Tax preparation for taxpayers in Tennessee can be conducted by most state offices and tax-preparation software providers. Visit MyTax.com to compare state-approved tax software and software providers or check with one of the state websites to determine which services are available to you. To find your service location click on the “Find a Tax Preparation Center” link in the lower right corner of your screen. Alternatively, you can use the “Where to File your Tennessee Tax Returns” link in the top left corner of this page.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Murfreesboro Tennessee Form 945-A, keep away from glitches and furnish it inside a timely method:

How to complete a Murfreesboro Tennessee Form 945-A?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Murfreesboro Tennessee Form 945-A aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Murfreesboro Tennessee Form 945-A from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.