Award-winning PDF software

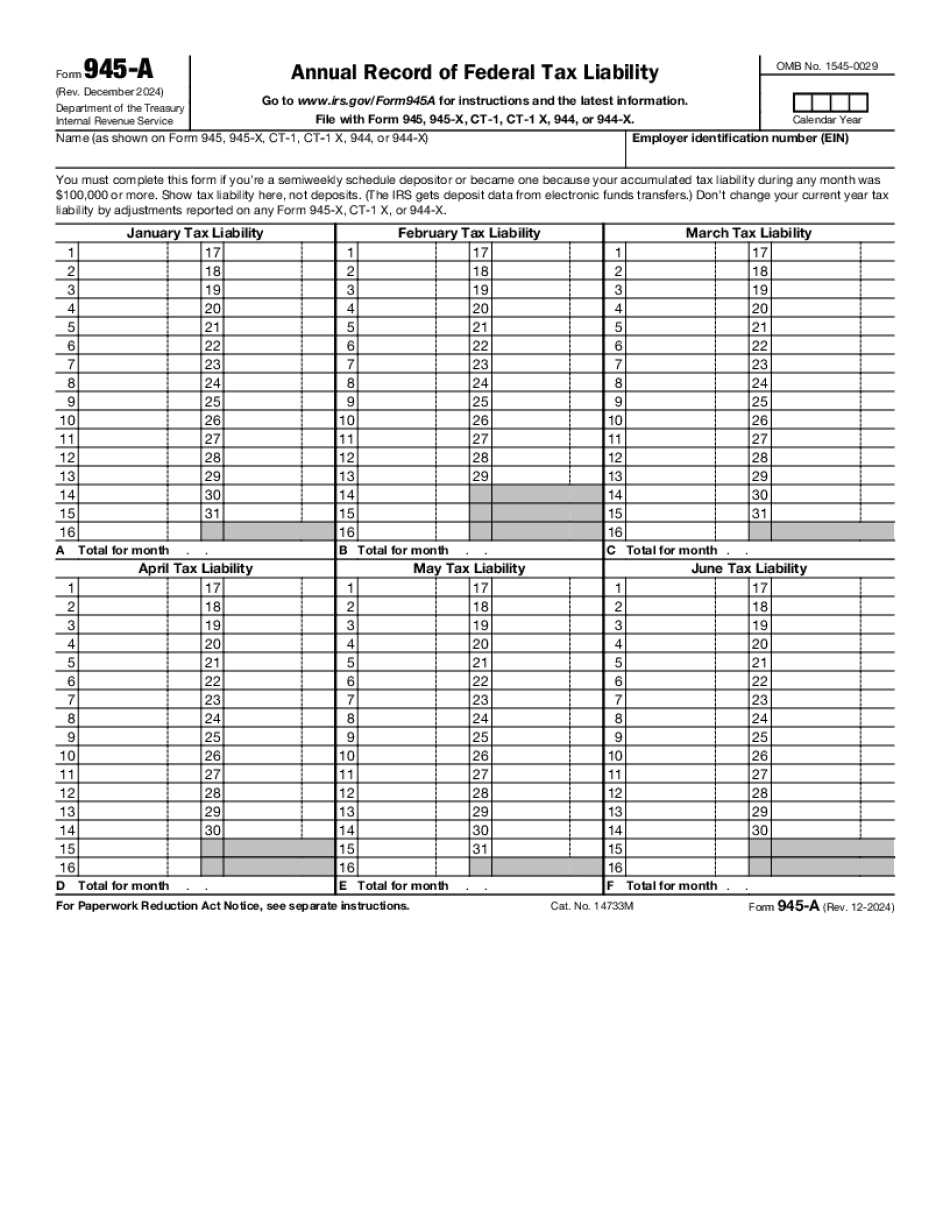

Form 945-A online Washington: What You Should Know

July 19, 2017. [Proposed collections include a range of items, including collections in which an amount not yet reported on Form 945 or Form 945-A was deposited by a taxpayer by check or money order for the purpose of filing as a return; collections of tax or interest due under the Internal Revenue Code or the Code under which the taxpayer was subject at the time of filing; or collections of the total of income tax and self-employment tax, federal estate tax, gift tax, payroll tax, excise tax, or any sum assessed at the level of the federal income tax bracket or the federal estate or gift tax for any month or portion of a month for which the IRS is aware of an offset of a credit for tax paid under such Code.] Form 945-A, Annual Record of Federal Tax Liability [electronic Internal Revenue Service; Format: Journal, Online; Instructions, [Washington, D.C.] Dept. of the Treasury, Internal Revenue Service. Technical Details. Jan 5, 2016. [Proposed collections include the collection under Sections 523 (a) (8) and 853 (e) (5) which is for the year ending on or before December 31. Proposed collections of tax may be reported as separate entries or entered into both separate items of Form 945 and Form 945-A.] Ex-Residences for Sale. Existing accounts, including those held by a taxpayer whose tax liability has been reduced to zero, and any amount of debt from a decedent's account and that was not refunded by a bankruptcy court are subject to the reduction of tax for certain property placed into service in the United States as of the date of death of the decedent. The reduction is an absolute reduction of tax and does not include a reduction for the tax to be paid on any deferred acquisition payments that the decedent was entitled to receive upon death. Form 8950, Estimated Tax Payment for the year. Notice of Availability Taxpayers must complete and mail forms #4 and 6 to: Clerk Office 100 South Capitol Street Washington, D.C. 20515 The Forms #4 and 6 must be postmarked on or before May 10, 2019. The IRS will not process your return until you have mailed the forms to the correct address. You may call the IRS directly to inquire about whether it has received your forms or if you need further assistance.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 945-A online Washington, keep away from glitches and furnish it inside a timely method:

How to complete a Form 945-A online Washington?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 945-A online Washington aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 945-A online Washington from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.