Award-winning PDF software

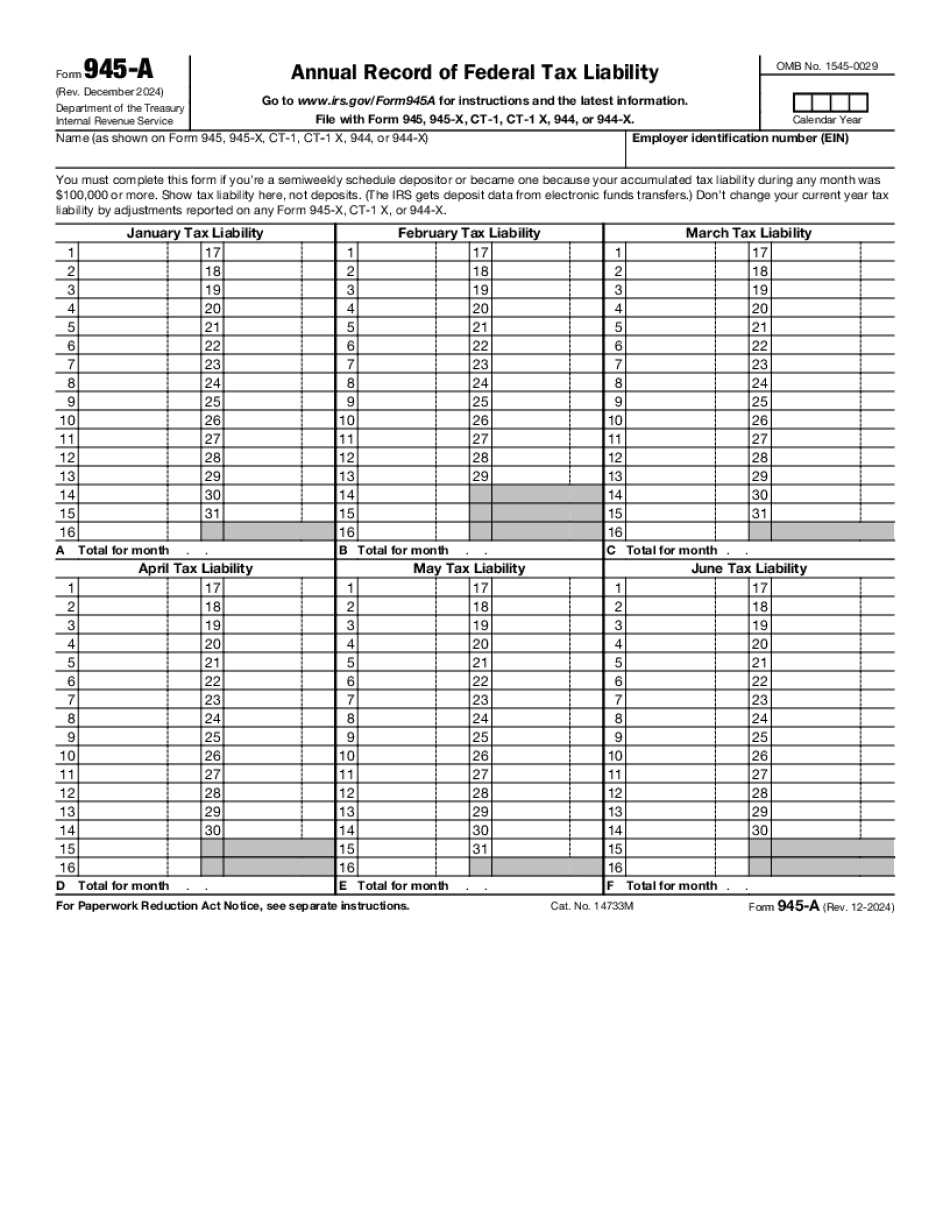

Form 945-A for New Jersey: What You Should Know

IRS Form 945 — Form 945.pdf (download) If you have the questions please download the Form 945 .pdf for your type of company. This form is very important because if you are a corporation, you are required to file Form 945. Form 945 is a tax liability report (Form 942). The IRS Form 945 must be filed by the end of the calendar year the payment was made. The deadline for the IRS Form 945 to be due is August 26, 2019. Form 945 must be filed electronically. Electronic filing reduces the need to file paper forms. Tax payments are typically reported using an online payment system, as well as electronic payments made through your payroll systems. If the payment does not reach the account on the date it was earned, the payment has not been reported on a Form 945. The IRS accepts most payments by mail, credit or debit card, check, electronic payments and wire transfer. For paper payment inquiries, call the IRS at or visit the IRS website. The IRS will send you an extension slip to allow for additional time to receive the payment. The extension can be extended during the year, or if your situation arises during the filing year, you can obtain an extension. If payment is not received to our account by the 20th business day after a Form 945 .pdf has been filed the payment is considered late, and you may be assessed interest and/or penalties. However, this is not a result of the payment failing to reach our account, but rather a result of a payment being made earlier than the required filing date. There is a penalty of 0.50 per month for an unpaid payment of more than six (6) months. If a payment is received after the due date, interest is charged at the then-current rate from the date the payment was received. The payment will be considered late if it is received after the 25th business day after filing the Form 945 in the calendar year for which the Form 945 is being filed. The penalty for late payment is two (2) times the unpaid tax. Any money over and above the penalty will become due in one (1) year. Do I need the Form 945 .pdf if I pay quarterly? No.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 945-A for New Jersey, keep away from glitches and furnish it inside a timely method:

How to complete a Form 945-A for New Jersey?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 945-A for New Jersey aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 945-A for New Jersey from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.